Will Sterling Silver Continue to Rise

Many investors are asking themselves, "When will silver go up?" Are market conditions are ripe for another run up in the silver price?

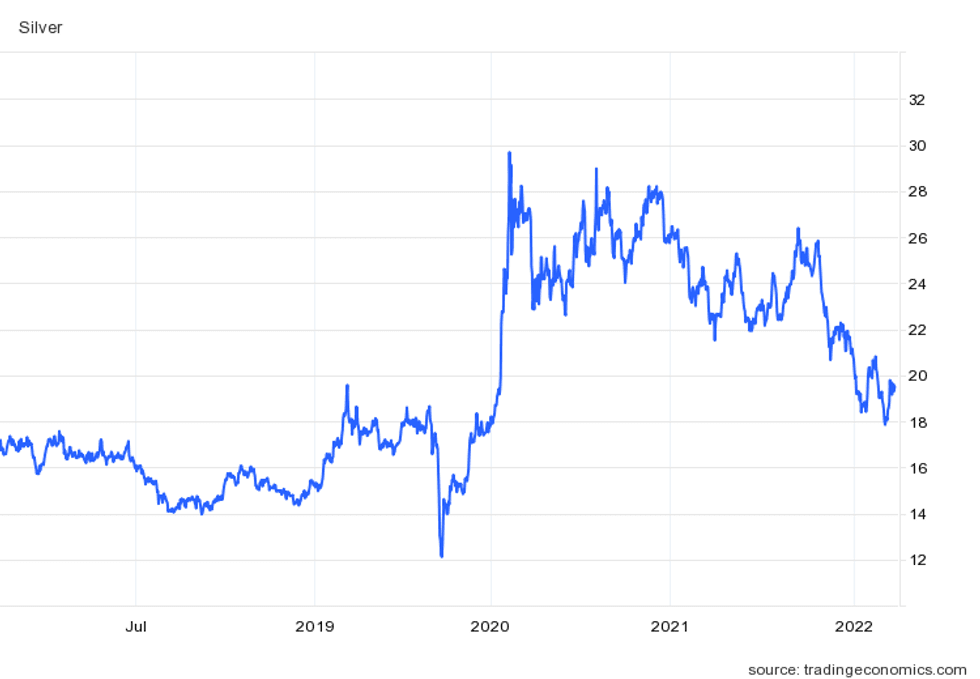

It's no secret that the silver market can be incredibly volatile. From September 2021 to September 2022 alone, the white metal has seen price levels ranging from below US$18 per ounce to US$26.50.

Many investors are confused by the precious metal's movement. After all, silver is a safe-haven asset that generally fares well in times of turmoil, and the past year has been packed with tense geopolitical events alongside the ongoing COVID-19 pandemic. The Russian-Ukraine war, increasing oil and gas prices and rising inflation have further heightened global economic uncertainty.

Unfortunately, answering the question, "When will silver go up?" is tricky. Even seasoned analysts can't tell the future, and it's difficult to find a consensus on the topic of when it will exit its bear market and enter a bull market.

Nevertheless, it's definitely possible to track down different opinions on the topic. Market participants interested in investing in silver would do well to keep these ideas top of mind as they try to determine where the spot price may move in the future.

When will silver go up?: Silver year-on-year

To approach the question, "When will silver go up?" it's useful to look at its past performance.

As mentioned, silver has had ups and downs over the past year. Its peak for the last 12 months came in early March at just below US$26.50, but since then it's moved gradually downward. Silver hit its lowest point when it fell below US$18 at the end of August.

Silver price chart, September 2017 to September 2022.

Chart via Trading Economics.

It's helpful to look at gold price drivers when trying to understand silver's price action. Silver is, of course, the more changeable of the two precious metals, but it often trades in relative tandem with gold bullion.

In fact, silver's run up from US$17 to over US$28 in the summer of 2020 coincided with gold reaching a record high of US$2,067.15 per ounce in August that year. Similarly, silver's spring 2022 breakout to over the US$26 level tracked with gold's rise to its highest price in history — US$2,074.60 on March 8, 2022.

For gold, and by extension, silver, a key price driver lately hasn't been so much supply and demand, but uncertainty. As noted, the past year has been filled with major geopolitical events — not only Russia's aggressive action in Eastern Europe and the COVID-19 pandemic, but also continued tension between the US and other countries such as China and Iran. Those and other developments have been major sources of concern for participants in the precious metals market.

Investors have also been closely following the US Federal Reserve's interest rate plans. Rate hikes are generally negative for silver and gold prices — that's because when rates are higher, it is more profitable to invest in products that can accrue interest.

Market participants who are looking to invest in silver and wondering, "When will silver go up?" will want to watch what central banks do. In response to inflation rising to a 40 year high in 2022, the Fed has begun hiking interest rates from 0 percent at the start of the year; they reached a range of 3 to 3.25 percent after the central bank's September hike, and economists don't expect the increases to stop there — the Fed has a target of 4.4 percent by the end of 2022.

When will silver go up?: Silver supply and silver demand

Moving forward, geopolitical events, the global impact of COVID-19 and future Fed rate changes will be key factors to watch.

But what about silver supply or silver demand? Interestingly, the 2022 World Silver Survey, published by the Silver Institute and Metals Focus, indicates that in 2021 the silver market experienced a 5 percent increase in mine production, contributing to an overall global silver supply increase of 5 percent. Much of this output was a slight rebound in production after the decline in 2020 brought on by the impact of COVID-19 lockdowns on operations.

In 2022, mine production is expected to increase by 2 percent to 843.2 million ounces, while overall global silver supply is seen rising by 3 percent to 1,030.3 billion ounces. Growth in mine production is anticipated to continue over the medium term. In the longer term, investment in further silver exploration and development will be needed to sustain mine production.

On the silver demand side, 2021 investor demand for silver bars and coins was up 36 percent year-on-year. "While the social media fueled silver squeeze in the early part of the year no doubt contributed to these gains, it was by no means the only factor," remarks the World Silver Council in its report. "Indeed, silver bar and coin demand proved robust even after that rush had dissipated, underpinned by retail investors' concerns towards political and geopolitical developments, negative real interest rates, global market risks and the looming specter of inflation."

However, holdings in exchange-traded products and in commodities trading experienced weakened demand. In fact, 2021 saw a dramatic pullback in trading on commodities exchanges, including on the COMEX.

Nevertheless, overall silver demand was up by 18 percent in 2021. Industrial demand enjoyed a notable 9 percent jump, with a 13 percent increase in demand from the photovoltaic industry, while photography experienced a more modest 3 percent rise. After physical silver, jewelry (21 percent) and silverware (32 percent) generated the next biggest increases to demand.

For 2022, growth in physical silver investment (such as silver bullion coins and silver bars) isn't expected to materialize. In fact, the year may also mean slower growth in industrial demand (forecast at 6 percent), jewelry (11 percent) and silverware (23 percent). Silver demand from the photography segment is expected to drop by 1 percent.

When will silver go up?: Silver in the future

While the silver price forecast is impacted by supply and demand, it is also heavily influenced by investors who buy precious metals as safe-haven assets during times of economic or political uncertainty.

CPM Group Managing Partner Jeffrey Christian believes that while gold and silver prices may be taking a hit in the short term, those investors with a longer-term market view may see this trough in prices as an opportunity.

"Our expectation is that prices do rise beyond September, October," Christian told the Investing News Network (INN) at a mid-June event. "Initially modestly, and then possibly stronger later." However, Christian advised silver investors to temper their expectations when it comes to how high silver will go, saying that triple-digit prices aren't in the cards.

Speaking to INN, silver guru David Morgan likened the current economic environment's impact on silver prices to that of 2008.

"I think silver will outperform just like in 2008 — gold doubled from the bottom, silver went up fivefold from the bottom. I think this time around they're acting stronger during this recessionary start, or depressionary start, and yet they will probably do better than they did in 2008," Morgan explained.

Of course, there's also the question of silver manipulation — experts such as Ed Steer of Gold and Silver Digest and GATA believe the silver price is controlled by entities like JPMorgan (NYSE:JPM) and will not rise significantly until these players allow it to do so.

However, these factors don't mean that the silver price will never again reach its highest price of nearly US$50. If the metal continues to rise this year, reaching higher prices will become more plausible.

In fact, Chris Marcus, founder of Arcadia Economics, who is the author of the book "The Big Silver Short," has described the white metal as "an amplified version of gold" and said he's surprised to see the white metal trading where it is.

Watch the full interview with Marcus and Brien Lundin above.

"I look at what happened in 2011, that's what the book gets into," said Marcus in an interview with INN. "Either the price came down because they sold a lot of paper that they can't back up, or maybe there's another explanation. But if that is correct, to me US$50 seems like a floor whenever a free market comes back."

For investors, a key point to remember is that the resource space operates cyclically — while a commodity like silver can experience price rises and falls, ultimately what goes up must come down and vice versa. The advice to "buy low and sell high" is repeated often for a reason, and though it's nigh impossible to predict market bottoms, at today's price now may certainly be a good time to flex your purchasing power.

This is an updated version of an article first published by the Investing News Network in 2015.

Don't forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Source: https://investingnews.com/daily/resource-investing/precious-metals-investing/silver-investing/when-will-silver-go-up/

0 Response to "Will Sterling Silver Continue to Rise"

Post a Comment